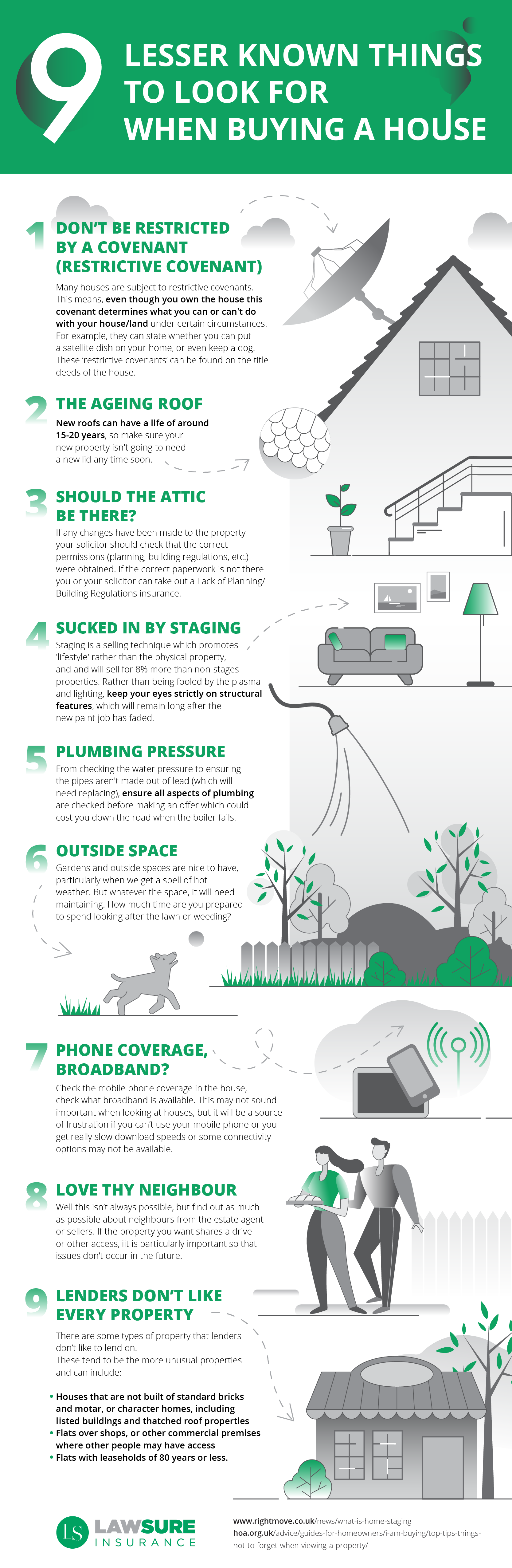

9 Lesser Known Things To Look For When Buying A House

Exploring common examples of issues homeowners can face, and how indemnity insurance can protect you.

When it comes to buying a home there’s no shortage of people telling you what to look out for. However, for those new to the process, there are a few key details which could go unseen and cause a dark cloud over your nice new home. In this infographic we’ve highlight 9 things that people often forget to mention when giving you home buying advice, including how restrictive covenants and staging work, and why they matter to future owners.

1. Don’t be restricted by a covenant (restrictive covenant)

Many houses are subject to restrictive covenants (property restrictions). These are binding conditions which are written into the deeds by a seller. Even though you own the house this covenant determines what you can or can’t do with your house/land under certain circumstances. These covenants can date back hundreds of years and relate to the use of the property, restrictions on extending and improving the property and in some modern developments even such things as whether you can put a satellite dish on your home, or even keep a dog! These ‘restrictive covenants’ can be found on the title deeds of the house, which your solicitor will have, or can be purchased from the land registry.

These rules can be enforced decades, or even centuries later, and in disputes, the Upper Tribunal Lands Chamber may get involved. If a covenant is breached, the original land owner or their successors could take enforcement action, which may involve adjoining land as well.

Because of the risks, many people seek legal advice and arrange indemnity insurance to protect against future claims. Your solicitor can obtain copies of the covenants from the Land Registry, ensuring you understand your obligations before committing to buy.

In some cases, homeowners may explore modifying restrictive covenants, but this often requires negotiation and, in certain circumstances, court proceedings. If attempts at resolution fail, the other party could pursue legal action, making it especially important to take professional advice early.

If you find there are restrictions don’t despair, your solicitor can take out restrictive covenant indemnity insurance which will protect you in the event of a claim against the covenant in the future (policies don’t have a time limit, so will last forever.)

2. The ageing roof

New roofs can have a life of around 15-20 years, so make sure your new property isn’t going to need a new lid any time soon. In some circumstances, older roofs may have been previously modified to comply with local building regulations or development requirements, but repairs or replacements can still be costly.

If the owner before you sold the property with any conditions that restrict alterations (such as prohibiting certain materials) you’ll need to comply to avoid issues.

It’s also worth noting that in some cases, roofing restrictions can be linked to planning grounds or conservation rules, which may limit your ability to modify the structure. Checking this before purchase helps avoid surprises and ensures your future plans take the right form.

3. Should the attic be there?

If any changes have been made to the property your solicitor should check that the correct permissions (planning, building regulations, etc.) were obtained. If the correct paperwork is not there you or your solicitor can take out a Lack of Planning/Building Regulations insurance. This will not only help you now but will make any sale in the future much easier.

4. Getting sucked in by staging

Staging is a selling technique which promotes ‘lifestyle’ rather than the physical property and typically sells for more than non-staged properties. Rather than being fooled by the massive plasma and expensive lighting, keep your eyes strictly on structural features, which will remain long after the new paint job has faded.

5. Plumbing pressure

From checking the water pressure to ensuring the pipes aren’t made out lead (which will need replacing), ensure all aspects of plumbing are checked before making an offer which could cost you down the road when the boiler fails.

6. Mobile & internet coverage

Check the mobile phone coverage in the house, check what broadband is available. This may not sound important when looking at houses, but it will be a source of frustration if you can’t use your mobile phone or you get really slow download speeds.

7. Outside space

Gardens and outside spaces are nice to have, particularly when we get a spell of hot weather. But whatever the space, it will need maintaining. How much time are you prepared to spend looking after the lawn or weeding?

8. Love thy neighbour

Well this isn’t always possible, but find out as much as possible about neighbours from the estate agent or sellers. If the property you want shares a drive or other access, it is particularly important so that issues don’t occur in the future.

9. Lenders don’t like every property

There are some types of property that lenders don’t like to lend on. These tend to be the more unusual properties and can include:

- Houses that are not build of standard bricks and mortar, or character homes, including listed buildings and thatched roof properties.

- Flats over shops, or other commercial premises where other people may have access

- Flats with leaseholds of 80 years or less